If you’ve ever stared at the FAFSA screen wondering, “Do I include my savings? My house? My 401(k)?” — you’re not alone. Every year, thousands of parents second-guess this exact section.

Here’s the truth: FAFSA’s definition of “assets” is much narrower than what most people imagine. Once you understand what belongs — and what doesn’t — you’ll fly through this section with confidence.

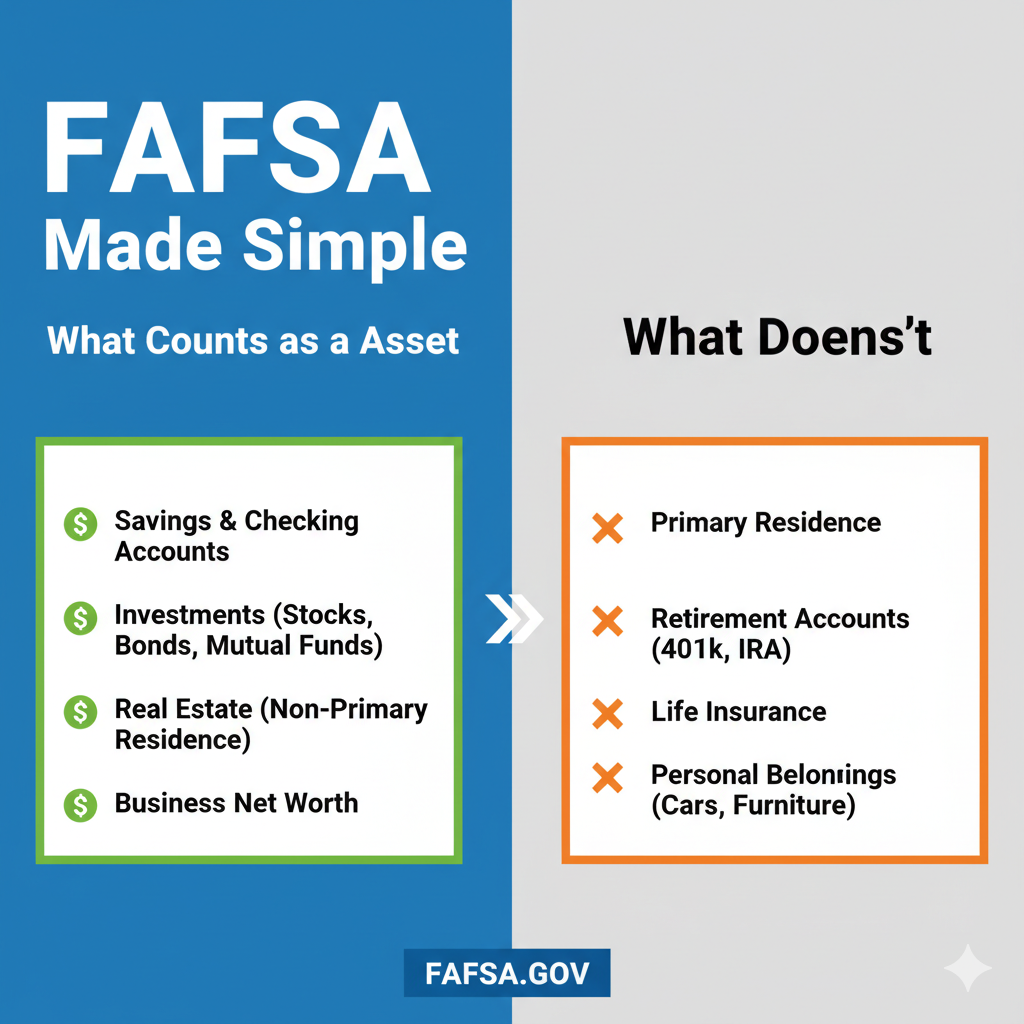

What FAFSA Really Means by “Assets”

When FAFSA asks for your assets, it’s not asking for everything you own. It’s specifically looking for non-retirement, cash-based investments that could, in theory, be used to help pay for college.

So before you start adding up every account in your life, let’s divide it into two simple columns.

Assets You Do Report

These are the items FAFSA wants you to include in your Parent Assets or Student Assets section

(depending on ownership).

1. Cash, Checking, and Savings

Report the total amount currently sitting in all bank accounts — even if it’s earmarked for bills or taxes. FAFSA uses your balance as of today, not an average.

Tip: You don’t have to wait until your paycheck clears or bills are paid — just use the day’s real balance.

2. 529 College Savings Plans

If you (the parent) are the owner of the 529 plan, it belongs under Parent Assets, not the student’s. Even though the account benefits your child, FAFSA sees it as parent-controlled money.

If Grandma or Grandpa owns the 529, you don’t report it at all — but withdrawals later may count as student income.

3. Investments and Brokerage Accounts

- Stocks, bonds, mutual funds, ETFs

- Non-retirement Charles Schwab or Fidelity accounts

- Certificates of Deposit (CDs)

Do not include any IRA, 401(k), or Roth IRA investments — those are excluded.

4. Other Real Estate (Not Your Home)

Own a rental property, vacation condo, or piece of land? FAFSA wants the net worth:

Market value – Debt owed = Net worth to report

Example: Rental condo worth $250,000 with $150,000 mortgage → Report $100,000.

Assets You Do Not Report

This is where most people accidentally inflate their FAFSA numbers.

1. Your Primary Home

The house you live in — and its mortgage — are completely excluded. FAFSA doesn’t want your home value or your loan balance.

2. Retirement Accounts

- 401(k), IRA, Roth IRA

- Pensions

- SEP/SIMPLE plans

You’ll list your income on FAFSA, not your retirement savings.

3. Small Family Business or Farm

If your family owns a small business with fewer than 100 employees (and it’s family-controlled), you don’t report it as an asset.

4. Personal Property

Cars, jewelry, furniture, clothing, art — none of these count. FAFSA sticks to financial assets only.

How to Calculate “Net Worth of Investments”

Use this simple formula:

(Current investment value) − (debts owed on those same investments)

Only subtract debts that are directly tied to those investments — for example, a mortgage on a rental property. Don’t subtract credit card balances, car loans, or personal debt.

Parent vs. Student Assets: What’s the Difference?

- Parent assets are assessed at about 5.6% of their value in aid calculations.

- Student assets are assessed at about 20% — a much bigger impact.

That’s why 529 plans and family savings should stay parent-owned, not under the student’s name.

Quick FAFSA Asset Checklist

Report Report |  Don’t Report Don’t Report |

|---|---|

| Cash, Checking, Savings | Primary Home |

| Parent-owned 529 Plans | Retirement Accounts |

| Stocks, Bonds, Mutual Funds | Cars, Jewelry, Personal Items |

| Non-retirement Brokerage Accounts | Small Family Business (<100 employees) |

| Rental / Investment Real Estate | Credit Card or Car Loans |

Final Takeaway

FAFSA isn’t trying to penalize you for saving — it’s simply trying to understand what funds are readily available. Once you know the rules, you can report your assets confidently (and accurately) without over- or under-reporting.

Pro tip: Keep a simple spreadsheet of your accounts — cash, 529s, investments — so next year’s FAFSA feels like a 10-minute task instead of an afternoon project.

Join Our Parent Community

Join Our Parent Community

If you found this helpful, join our College App Navigator Facebook Group, where parents share FAFSA tips, college deadlines, and financial aid success stories — all judgment-free.

Join here

Join here